Introduction for Property Purchase

Property investment represents one of the most significant financial decisions in a person’s lifetime. However, the excitement of acquiring real estate can quickly turn into a nightmare if proper legal due diligence is not conducted. Legal document verification as part of Property Purchase Checklist forms the backbone of secure property transactions, protecting buyers from fraud, disputes, and financial losses.

Legal documentation verification is the systematic process of examining, authenticating, and validating all legal papers associated with a property transaction. This process ensures that the seller has clear title, the property is free from encumbrances, and all regulatory approvals are in place. Without proper verification, buyers risk purchasing properties with disputed ownership, pending litigation, or regulatory non-compliance.

The Indian real estate market, valued at over ₹13 trillion, sees millions of transactions annually. However, studies indicate that nearly 70% of property disputes arise from inadequate document verification. This comprehensive guide will equip you with the knowledge and tools to navigate the complex landscape of property documentation safely.

Property Purchase Checklist [Click here to download the checklist]

Key Methodologies & Processes involved in Property Purchase

Core Verification Framework

The legal document verification process follows a structured methodology that can be broken down into six fundamental stages:

Preliminary Document Collection Begin by obtaining all relevant documents from the seller. Create a master checklist and ensure every document is provided in original format with certified copies. The verification timeline typically spans 15-30 days depending on property complexity.

Title Verification Process Conduct a comprehensive title search covering a minimum 30-year history. This involves examining the chain of ownership, identifying any breaks in the title, and ensuring the seller has absolute ownership rights. Use state registration portals to cross-verify document authenticity.

Regulatory Compliance Check Verify all statutory approvals including RERA registration, building plan approvals, and occupancy certificates. Cross-reference project details with official government portals to confirm authenticity.

Financial Due Diligence Examine all tax-related documents, pending dues, and financial clearances. This includes property tax receipts, stamp duty payments, and capital gains tax compliance.

Third-Party Clearances Obtain and verify all NOCs from relevant authorities including society approvals, fire safety certificates, and utility connections.

Risk Assessment Identify potential red flags through fraud detection mechanisms, litigation searches, and forensic document examination.

Property Purchase Checklist [Click here to download the checklist]

Industry Standards and Compliance

IS Codes and Standards:

- IS 15900: Guidelines for real estate project development

- IS 456: Code of practice for plain and reinforced concrete

- NBC 2016: National Building Code compliance requirements

International Best Practices:

- Due diligence standards aligned with International Property Measurement Standards (IPMS)

- Risk assessment frameworks based on Global Real Estate Standards

- Documentation protocols following International Valuation Standards (IVS)

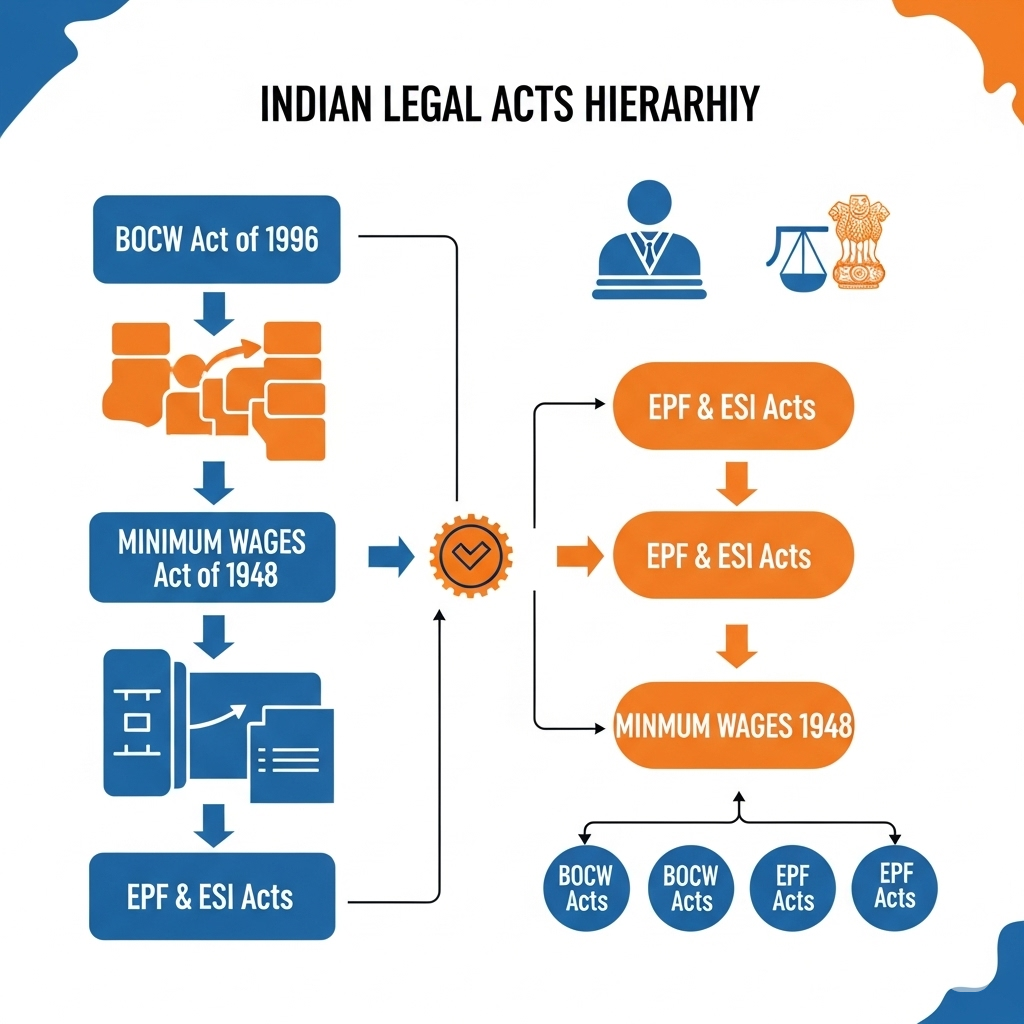

Legal Framework Compliance:

- Real Estate (Regulation and Development) Act, 2016

- Registration Act, 1908

- Transfer of Property Act, 1882

- Indian Stamp Act, 1899

Material & Manpower Requirements

Essential Materials and Tools

Documentation Requirements:

- Original property documents and certified copies

- Legal stationery for agreements and declarations

- Stamp papers for various legal instruments

- Digital storage systems for document management

Technology Infrastructure:

- High-resolution scanners for document digitization

- Secure cloud storage with encryption capabilities

- Legal database access subscriptions

- Property portal access credentials

Verification Tools:

- Magnifying glasses for detailed document examination

- UV lights for security feature verification

- Digital signature verification software

- Forensic document analysis equipment

Property Purchase Checklist [Click here to download the checklist]

Manpower and Expertise

Core Team Composition:

- Lead Legal Advisor: Qualified property lawyer with 5+ years experience

- Document Analyst: Professional trained in forensic document examination

- Compliance Officer: Expert in regulatory requirements and approvals

- Research Assistant: Individual skilled in online portal navigation

Specialized Consultants:

- Chartered Accountant for tax-related verification

- Technical Engineer for building approval assessment

- Survey Expert for boundary and measurement verification

- Title Insurance Specialist for risk evaluation

Property Purchase Checklist [Click here to download the checklist]

Skill Requirements:

- Advanced knowledge of property laws and regulations

- Proficiency in using government portals and databases

- Understanding of construction and development processes

- Expertise in fraud detection and prevention techniques

Deliverables at Each Stage & Impact Analysis

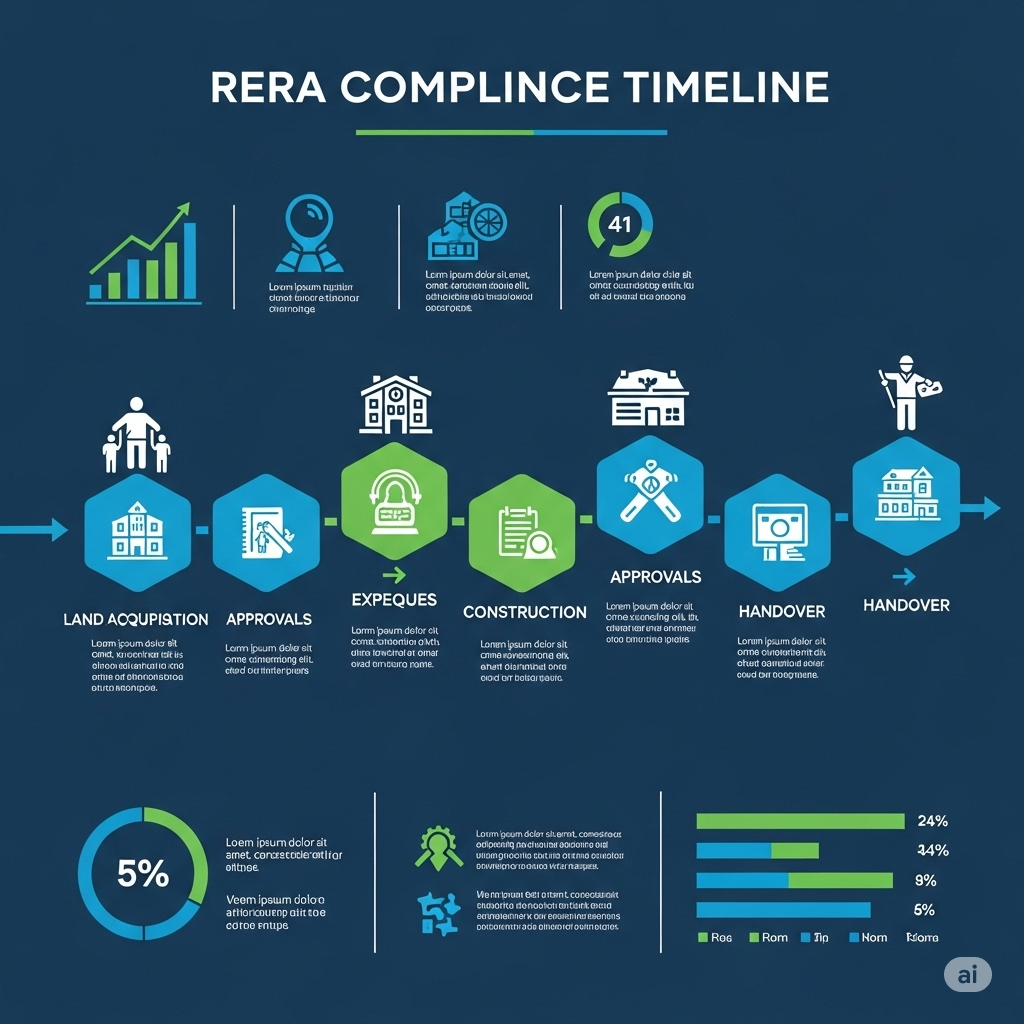

Pre-Construction Phase

Document Verification Report: A comprehensive analysis covering title authenticity, ownership chain verification, and regulatory compliance status. This report forms the foundation for purchase decisions and typically spans 25-30 pages with detailed findings and recommendations.

Risk Assessment Matrix: Quantified evaluation of potential legal, financial, and regulatory risks associated with the property. This matrix helps buyers understand exposure levels and make informed decisions.

Compliance Checklist: Detailed verification status of all mandatory approvals and clearances required for the specific property type and location.

Impact on Decision Making: Proper pre-construction verification prevents 85% of common property disputes and ensures buyers can proceed with confidence or negotiate better terms based on identified issues.

Property Purchase Checklist [Click here to download the checklist]

Construction Phase

Progress Verification Reports: Monthly assessments comparing actual construction progress with approved building plans. These reports ensure compliance with sanctioned designs and identify deviations early.

Statutory Compliance Updates: Regular monitoring of ongoing compliance requirements including environmental clearances, labor compliance, and safety certifications.

Amendment Documentation: Proper recording and approval of any changes to original building plans or project specifications.

Impact on Project Success: Construction phase verification reduces project delays by 40% and minimizes cost overruns through early identification of compliance issues.

Property Purchase Checklist [Click here to download the checklist]

Post-Construction Phase

Occupancy Certificate Verification: Confirmation that the completed construction meets all approved specifications and safety requirements. This certificate is essential for legal occupation and property financing.

Final Title Transfer Documentation: Complete verification of sale deed execution, registration processes, and title transfer formalities.

Handover Compliance Report: Final assessment ensuring all utilities, amenities, and legal requirements are fulfilled before property handover.

Impact on Long-term Ownership: Post-construction verification ensures smooth property transfer and eliminates future legal complications, protecting the buyer’s investment for decades.

Stakeholders & Communication Matrix

Key Stakeholders

Primary Stakeholders:

- Property Buyer: The end customer requiring comprehensive legal protection

- Property Seller: Individual or entity transferring ownership rights

- Legal Advisor: Professional responsible for document verification and legal opinion

- Registration Authority: Government official overseeing legal property transfer

Secondary Stakeholders:

- Financial Institution: Banks or NBFCs providing property financing

- Real Estate Agent: Intermediary facilitating the transaction

- Technical Consultant: Engineer or architect verifying construction compliance

- Insurance Provider: Company offering title or property insurance

Regulatory Stakeholders:

- RERA Authority: State-level regulatory body for real estate projects

- Municipal Corporation: Local government authority for building approvals

- Revenue Department: Government body maintaining land records

- Registrar Office: Authority responsible for property registration

Communication Protocols

Weekly Progress Meetings: Structured discussions between legal team, buyer, and primary stakeholders to review verification progress and address emerging issues.

Documentation Sharing Framework: Secure digital platforms for sharing sensitive legal documents with appropriate access controls and audit trails.

Escalation Procedures: Clear protocols for addressing urgent issues or disputes during the verification process, including emergency contact procedures and decision-making authority.

Reporting Standards: Standardized formats for progress reports, risk assessments, and final recommendations to ensure consistent communication across all stakeholders.

Property Purchase Checklist [Click here to download the checklist]

Value Engineering Opportunities

Cost Optimization Strategies

Digital Documentation Systems: Implementation of paperless verification processes can reduce documentation costs by 30-40% while improving accuracy and accessibility. Digital systems also enable faster cross-verification and reduce storage expenses.

Bulk Verification Services: For developers or investors handling multiple properties, negotiating bulk rates with legal service providers can achieve 15-25% cost savings compared to individual property verifications.

Technology Integration: Utilizing AI-powered document analysis tools can reduce manual verification time by 50% while improving accuracy in detecting fraudulent documents or missing information.

Standardized Processes: Developing standardized verification checklists and procedures reduces training costs and improves efficiency across verification teams.

Quality Enhancement Methods

Multi-Level Verification: Implementing multiple checkpoints in the verification process ensures higher accuracy without significantly increasing costs. This approach reduces error rates by up to 75%.

Collaborative Platforms: Using shared digital platforms for stakeholder collaboration improves communication efficiency and reduces delays caused by information gaps.

Continuous Training Programs: Regular training updates for verification teams on new regulations and fraud detection techniques maintain high service quality standards.

Quality Assurance Protocols: Implementing systematic quality checks and peer reviews ensures consistent service delivery and minimizes oversight risks.

Case Study: Successful Property Verification in Bangalore

Project Overview

Property Details:

- Location: Electronic City, Bangalore

- Property Type: 3-bedroom apartment in a RERA-registered project

- Property Value: ₹85 lakhs

- Transaction Timeline: March 2024

Buyer Profile: Software professional relocating from Mumbai, first-time property buyer in Bangalore with limited knowledge of local regulations and documentation requirements.

Challenges Faced

Complex Ownership History: The property had changed hands three times in the past 15 years, creating a complex chain of title transfers. One previous owner had used a Power of Attorney for the sale, which required additional verification.

Khata Certificate Issues: The property had a B-Khata classification instead of the expected A-Khata, indicating potential tax compliance issues that needed resolution before purchase.

RERA Compliance Gaps: Initial verification revealed discrepancies between the RERA registration details and the actual project specifications, requiring detailed investigation.

Financial Clearance Complications: The previous owner had outstanding property tax dues that were not initially disclosed, creating potential liability for the new buyer.

Solutions Implemented

Comprehensive Title Search: Conducted a 35-year title search using both digital records and physical verification at the Sub-Registrar office. This revealed that the Power of Attorney used in a previous transaction was valid and properly executed.

Khata Regularization: Worked with the seller to convert the B-Khata to A-Khata status by clearing all pending tax dues and obtaining proper approvals from the Municipal Corporation.

RERA Verification Process: Cross-verified all project details with the Karnataka RERA website and obtained clarification from the developer regarding specification discrepancies. All issues were resolved satisfactorily.

Financial Due Diligence: Negotiated with the seller to clear all outstanding dues before the final transaction and obtained proper clearance certificates from relevant authorities.

Risk Mitigation Measures: Obtained comprehensive legal opinion from a qualified property lawyer and arranged for title insurance to protect against any unforeseen issues.

Results & Key Takeaways

Successful Transaction Completion: The property purchase was completed successfully within 45 days of initiating the verification process. All legal documents were properly verified and registered.

Cost Savings: The thorough verification process identified tax dues that would have become the buyer’s responsibility, saving approximately ₹2.3 lakhs in unexpected costs.

Risk Elimination: Comprehensive verification eliminated all identified legal and financial risks, providing the buyer with complete peace of mind and clear property title.

Long-term Benefits: The buyer obtained all necessary clearances and certificates, ensuring smooth future transactions and avoiding potential legal complications.

Key Learning Points:

- Always verify Khata status in Bangalore properties

- RERA registration alone doesn’t guarantee compliance

- Historical title searches often reveal hidden issues

- Professional legal advice is essential for complex transactions

Risks & Mitigation Strategies

Legal and Documentation Risks

Title Disputes and Ownership Issues: Properties with unclear or disputed titles represent the highest risk category in real estate transactions. These disputes can arise from forged documents, invalid transfers, or competing ownership claims.

Mitigation Strategy: Conduct comprehensive title searches covering minimum 30 years of ownership history. Verify all transfer documents and obtain legal opinions from qualified property lawyers. Consider title insurance for high-value transactions.

Fraudulent Documentation: Sophisticated document forgery techniques make it increasingly difficult to identify fake papers. Common targets include sale deeds, no-objection certificates, and approval documents.

Mitigation Strategy: Use forensic document analysis techniques including paper quality assessment, signature verification, and cross-referencing with official databases. Always verify documents directly with issuing authorities.

Regulatory Non-Compliance: Properties without proper approvals face risks of demolition, penalties, or inability to obtain essential services. Non-compliance issues often become apparent only after purchase completion.

Mitigation Strategy: Verify all statutory approvals through official government portals. Obtain fresh certificates where validity periods have expired. Ensure RERA registration is current and accurate.

Financial and Tax Risks

Hidden Liabilities and Dues: Undisclosed financial obligations including property taxes, utility dues, or maintenance charges can become the buyer’s responsibility after transfer.

Mitigation Strategy: Demand clearance certificates from all relevant authorities. Verify tax payment status through official portals. Include liability transfer clauses in purchase agreements.

Stamp Duty and Registration Issues: Incorrect stamp duty payment or registration irregularities can invalidate property transfers and result in penalty payments.

Mitigation Strategy: Calculate stamp duty accurately using official tools. Verify e-stamp paper authenticity through government portals. Ensure proper registration procedures are followed.

Market and Investment Risks

Location and Development Risks: Properties in areas with uncertain development prospects or infrastructure challenges may not appreciate as expected.

Mitigation Strategy: Research local development plans and infrastructure projects. Verify zoning classifications and development restrictions. Consider connectivity and amenity availability.

Liquidity and Resale Risks: Some properties may be difficult to sell due to legal issues, location factors, or market conditions.

Mitigation Strategy: Choose properties with clear titles in established locations. Avoid properties with unique legal structures or restrictions. Consider market demand patterns and future growth prospects.

Visual Aids and Data Analysis

Cost-Benefit Analysis of Document Verification

The investment in professional document verification typically ranges from ₹15,000 to ₹50,000 depending on property complexity. However, this investment protects against potential losses that can range from ₹1 lakh to several crores in case of legal disputes or fraud.

Verification Cost Breakdown:

- Legal consultation and opinion: 40%

- Document analysis and forensic examination: 25%

- Government portal searches and verifications: 20%

- Third-party clearances and NOCs: 15%

Risk Mitigation Value: Studies show that comprehensive verification reduces the probability of legal disputes by 85% and financial losses by 92%, making it one of the highest-return investments in property transactions.

Document Verification Timeline

The typical verification process follows a structured timeline:

Week 1-2: Document collection and preliminary assessment Week 3-4: Title search and ownership verification Week 5-6: Regulatory compliance and approval verification Week 7-8: Financial due diligence and clearance verification Week 9-10: Final report preparation and legal opinion

This timeline can be compressed to 4-6 weeks for straightforward properties or extended to 12-16 weeks for complex cases involving multiple issues.

Stakeholder Communication Flow

Effective communication follows a hub-and-spoke model with the legal advisor at the center coordinating between all stakeholders. This ensures information consistency and prevents miscommunication that could delay the verification process.

Risk Assessment Matrix

Properties are classified into four risk categories:

- Low Risk (Green): New projects with clear titles and complete approvals

- Medium Risk (Yellow): Properties with minor documentation gaps or expired approvals

- High Risk (Orange): Properties with ownership disputes or significant compliance issues

- Critical Risk (Red): Properties with fraud indicators or major legal complications

Conclusion & Further Reading

Legal document verification represents the most critical phase of any property transaction, serving as the foundation for secure and successful real estate investments. This comprehensive guide has outlined the essential processes, methodologies, and best practices that ensure thorough due diligence and risk mitigation.

The key to successful property verification lies in systematic approach, professional expertise, and attention to detail. By following the structured checklist and verification procedures outlined in this guide, buyers can significantly reduce their exposure to legal and financial risks while ensuring clear property titles and regulatory compliance.

Summary of Critical Success Factors:

- Comprehensive title search covering minimum 30-year history

- Verification of all statutory approvals and regulatory compliance

- Professional legal opinion from qualified property lawyers

- Forensic examination of all critical documents

- Financial due diligence including tax and liability clearances

- Risk assessment and mitigation planning

The investment in professional document verification, typically ranging from 0.5% to 1% of property value, provides protection against potential losses that can reach 100% of the investment. This makes verification one of the most cost-effective risk mitigation strategies in real estate transactions.

Recommended Next Steps: For readers planning property purchases, we recommend engaging qualified legal professionals early in the process and allowing adequate time for comprehensive verification. For industry professionals, continuous education on evolving regulations and fraud detection techniques remains essential for maintaining service quality.